Europe Watch Market Graph

Europe Watch Market Overview in 2025

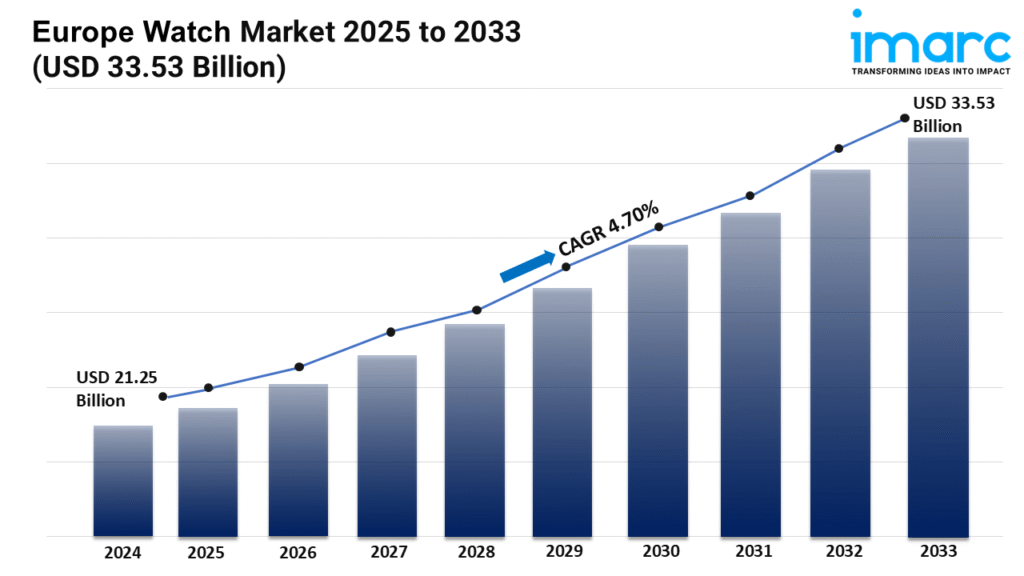

Market Size in 2024: USD 21.25 Billion

Market Forecast in 2033: USD 33.53 Billion

Market Growth Rate 2025-2033: 4.70%

The Europe watch market recorded a valuation of USD 21.25 billion in 2024 and is expected to reach USD 33.53 billion by 2033, registering a steady compound annual growth rate of 4.70% from 2025 to 2033. This growth is fuelled by rising disposable incomes, a strong heritage luxury positioning, and expanding consumer appetite for premium timepieces across both mechanical and smart segments.

Growth drivers shaping the European watch market

Swiss Made heritage and export momentum

The Federation of the Swiss Watch Industry reported that Swiss watch exports to the EU crossed CHF 10.3 billion in 2023, up 7.8% year on year, reinforcing Europe’s role as the core consumption hub. Brands are leveraging protected geographical indication status to justify premium pricing and drive collector demand. In March 2024, the Swiss government extended CHF 110 million in innovation grants to movement manufacturers developing low-carbon alloys, ensuring the continued supply of high-end mechanical calibres that dominate European shelves. Paris-based auction house Christie’s set a European record in May 2024 when a 1950s Patek Philippe reference sold for EUR 3.4 million, spotlighting the region’s appetite for rare pieces and underpinning retail confidence.

Smartwatch integration with digital health ecosystems

The European Commission’s approval of the Medical Device Regulation 2021 rollout has pushed wearable accuracy standards higher, encouraging traditional watchmakers to launch hybrid models. Apple received CE certification for its Series 9 ECG feature in 2023, and Samsung followed suit with the Galaxy Watch 6 in February 2024. European insurers are now offering premium discounts of up to 15% for policyholders who share verified activity data, creating a tangible financial incentive to upgrade. Garmin’s 2024 European user survey shows that 42% of respondents purchased a smartwatch primarily for heart-rate monitoring, a use case that continues to broaden the addressable audience beyond tech enthusiasts to mainstream luxury buyers.

Resurgence of experiential luxury among Gen-Z and millennials

Eurostat data indicate that consumers aged 20-35 in Germany, France and Italy increased luxury spending by 11% in 2023, with watches accounting for the largest share after leather goods. Brands are responding with immersive flagship formats: Omega reopened its Paris Rue Saint-Honoré boutique in April 2024 featuring a VR space mission experience, while TAG Heuer launched a Monaco pop-up in London that attracted 28,000 visitors in ten days. Limited-edition drops aligned with sustainability narratives further resonate; Swatch’s 2024 “Bioceramic MoonSwatch” sold out online within 43 minutes, demonstrating that storytelling and scarcity can convert digital traffic into physical queue culture, ultimately driving incremental sales across the broader Europe watch market ecosystem.

To receive the full sample report and detailed data sheet, please click here: https://www.imarcgroup.com/europe-watch-market/requestsample

Europe Watch Market Segmentation:

Breakup by Type:

- Quartz

- Mechanical

Analysis by Price Range:

- Low-Range

- Mid-Range

- Luxury

Analysis by Distribution Channel:

- Online Retail Stores

- Offline Retail Stores

Analysis by End User:

- Men

- Women

- Unisex

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Europe Watch Market news

- May 2024: Richemont unveiled a solar-powered perpetual calendar ladies’ watch under the IWC Schaffhausen brand at Watches and Wonders Geneva, targeting eco-conscious luxury buyers.

- April 2024: Swatch Group partnered with Blancpain to release a biodegradable strap variant of the Fifty Fathoms diver, reinforcing sustainability credentials across the Europe watch market.

- March 2024: LVMH announced that TAG Heuer will integrate Amazon Alexa voice assistant into its 2025 smartwatch lineup, enabling hands-free hotel and flight bookings for European travellers.

- February 2024: Seiko opened its largest European flagship on London’s Oxford Street, featuring an in-house watchmaker bar for same-day strap and battery changes.

- January 2024: The Federation of the Swiss Watch Industry launched a blockchain-based digital passport pilot with 10 brands to authenticate pre-owned timepieces sold inside the EU.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.