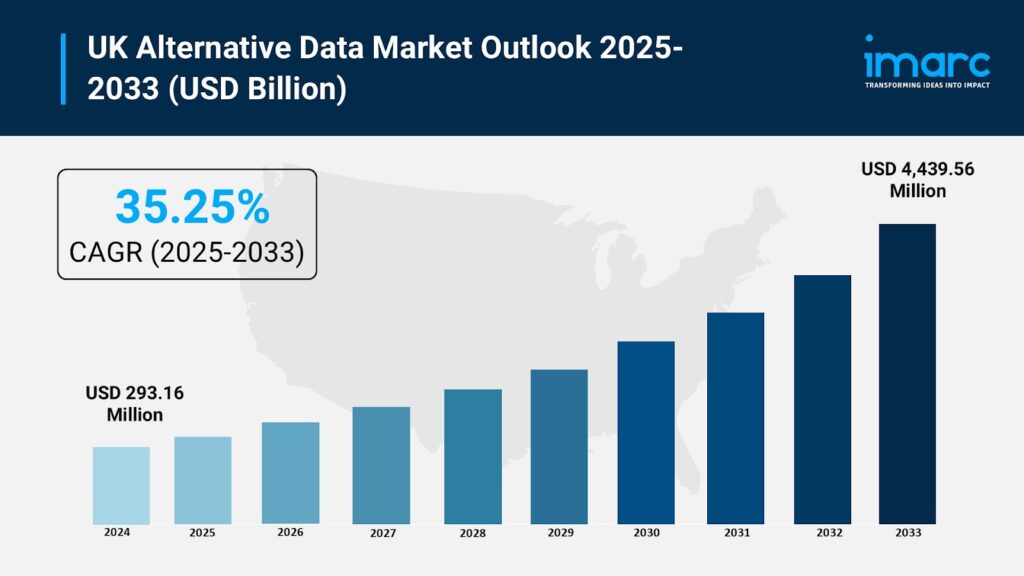

UK Alternative Data Market Overview

Market Size in 2024: USD 293.16 Million

Market Forecast in 2033: USD 4,439.56 Million

Market Growth Rate: 35.25% (2025-2033)

According to the latest report by IMARC Group, the UK alternative data market size reached USD 293.16 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,439.56 Million by 2033, exhibiting a CAGR of 35.25% during 2025-2033. The market is driven by increased digitalisation, widespread adoption of open finance frameworks, rising demand for predictive analytics in finance and retail, and advancements in AI-driven tools. Market maturity, regulatory clarity, and data accessibility continue to attract institutional investment and innovation across sectors, enhancing the UK alternative data market share.

UK Alternative Data Industry Trends and Drivers:

Growing Adoption of Digital Technologies and Open Finance

The UK alternative data market is growing rapidly as businesses in finance, retail, and technology are adopting digital tools to make smarter and faster decisions. Companies are now using non-traditional data sources such as social media activity, website traffic, location data, and transaction information to understand market trends, customer behavior, and competition more clearly. The rise of open finance is expanding access to real-time data, helping banks, fintech firms, and investors use alternative datasets for predictive analytics, credit scoring, and risk management.

Cloud-based platforms and AI-powered data tools are making it easier to collect, clean, and analyze large amounts of complex data, turning it into actionable insights quickly and accurately. Institutional investors are using alternative data for portfolio management, trading strategies, and market forecasting. Retailers and e-commerce companies are also using it to improve pricing, inventory control, and personalized marketing. With new advances in machine learning and natural language processing, businesses can now analyze unstructured data such as news, social media posts, and satellite images. Together, digitalization, AI, and open finance are driving innovation across industries, strengthening data-driven decision-making, and supporting the rapid expansion of the UK alternative data market.

Rising Need for Predictive Analytics and Strategic Insights

Organizations are increasingly turning to alternative data to make better predictions, reduce risks, and plan long-term strategies. This growing need for data-driven insights is fueling the expansion of the UK alternative data market. Financial institutions are combining traditional and alternative data to improve credit scoring, market monitoring, and investment performance. Retailers and consumer goods companies are using it to study changing customer preferences, predict demand, and customize products, boosting sales and customer loyalty.

Emerging industries like insurance, logistics, and real estate are using alternative data for predictive modeling, helping with risk management, fraud detection, and resource allocation. AI-powered analytics tools are supporting businesses with real-time insights, scenario planning, and sentiment analysis. Collaboration between data providers and companies is leading to innovative new services, while clear regulations are increasing trust and encouraging adoption. By combining predictive analytics with reliable, high-quality alternative data, companies are improving their decision-making accuracy, becoming more flexible, and staying competitive — all of which are accelerating market growth in the UK.

Supportive Regulations and Institutional Investment Driving Growth

The UK alternative data market is expanding strongly due to supportive regulations, improved data governance, and rising institutional investments. Government initiatives promoting transparency, data sharing, and responsible usage are helping create a fair and open environment for data providers and users. Institutional investors, hedge funds, and venture capital firms are actively investing in alternative data startups and analytics platforms, driving innovation and scalability.

Collaboration between universities, technology firms, and financial institutions is helping develop advanced analytical models and machine learning algorithms that deliver deeper insights into markets and customer behavior. Improved interoperability between data systems and cloud networks is making data sharing faster and safer, while maintaining strict privacy standards. With strong regulatory support, institutional funding, and ongoing innovation, the UK alternative data market is building a sustainable foundation for long-term growth. It continues to attract new players and is playing a key role in shaping smarter, faster, and more data-driven business strategies across finance, retail, and emerging industries.

Download sample copy of the Report: https://www.imarcgroup.com/uk-alternative-data-market/requestsample

UK Alternative Data Industry Segmentation:

The report has segmented the market into the following categories:

Data Type Insights:

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite and Weather Data

- Social and Sentiment Data

- Web Scraped Data

- Web Traffic

- Others

Industry Insights:

- Automotive

- BFSI

- Energy

- Industrial

- IT and Telecommunications

- Media and Entertainment

- Real Estate and Construction

- Retail

- Transportation and Logistics

- Others

End User Insights:

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Others

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=38296&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC’s offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302