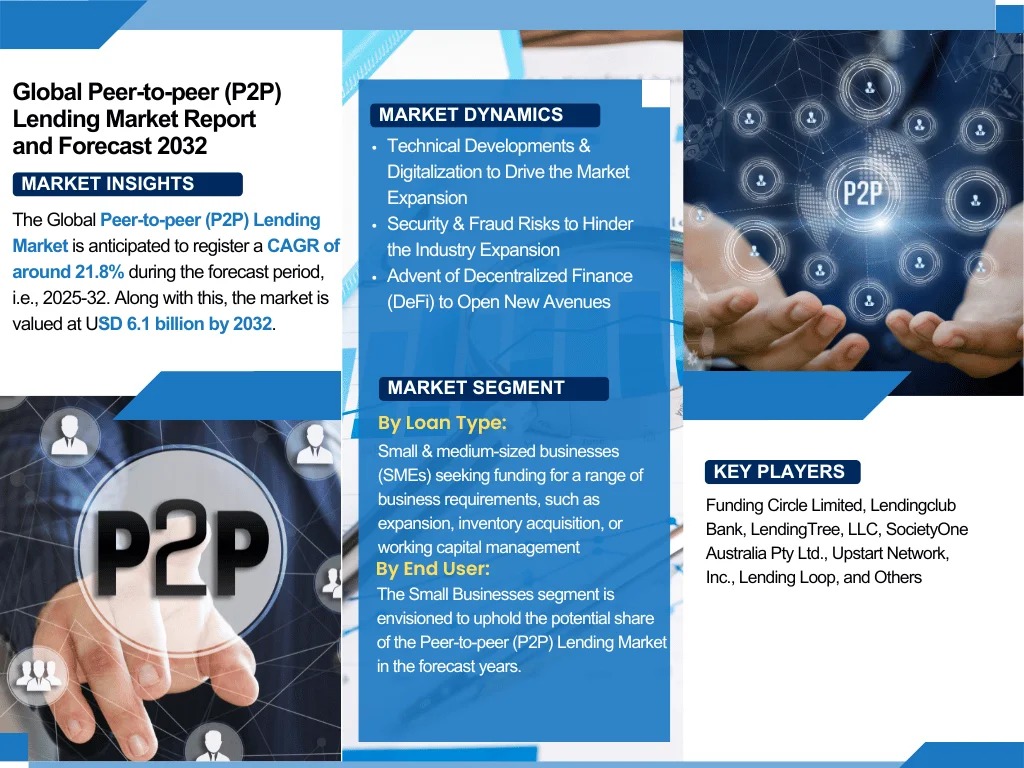

The Global Peer-to-Peer (P2P) lending market is experiencing significant growth as alternative financing solutions gain traction among individuals and small businesses. Traditional lending avenues often present challenges for those with limited credit histories, prompting an increasing number of borrowers to turn towards P2P lending platforms. These platforms facilitate direct lending between individuals or businesses, eliminating the need for traditional financial institutions as intermediaries. With an anticipated compound annual growth rate (CAGR) of approximately 21.87% during the forecast period from 2025 to 2032, the Peer-to-Peer (P2P) lending market is projected to reach a valuation of USD 6.1 billion by 2032. This dynamic landscape is characterized by evolving technologies, a rising acceptance of digital solutions, and changing consumer attitudes towards borrowing and investing.

Peer-to-Peer (P2P) Lending Market Statistics

- Expected CAGR (2025-2032): 21.87%

- Projected Market Value by 2032: USD 6.1 billion

- Major Growth Region: North America

- Dominant Loan Type: Unsecured personal loans account for the majority of P2P lending.

Fill the Form and Get Free Sample PDF – https://www.thereportcubes.com/request-sample/peer-to-peer-lending-market

Peer-to-Peer (P2P) Lending Market Driver

The primary driving force behind the growth of the Peer-to-Peer (P2P) lending market is the increasing demand for alternative funding solutions. Many individuals and small businesses face obstacles when seeking loans from traditional financial institutions due to stringent credit requirements and lengthy application processes. P2P lending platforms address this issue by providing faster and more accessible options for obtaining funds. With streamlined loan application processes, enhanced transparency, and competitive interest rates, these platforms empower borrowers to make informed decisions by comparing various offers. Moreover, the rise of digital technology and innovative financial solutions significantly reduces operational costs, enabling lenders to offer more attractive terms. As attitudes towards borrowing and investing evolve, P2P lending is poised to become a vital component of the financial landscape.

Segment and Regional Peer-to-Peer (P2P) Lending Market

By Lending Type:

- Consumer Lending

- Business Lending

By Loan Type:

- Secured Loans

- Unsecured Loans

By End User:

- Individual Borrowers

- Small Businesses

By Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia-Pacific

Want to See Full Insight, Visit Website – https://www.thereportcubes.com/report-store/peer-to-peer-lending-market

Peer-to-Peer (P2P) Lending Market Competition and Top Competitor Companies

- Funding Circle Limited

- Lendingclub Bank

- LendingTree, LLC

- SocietyOne Australia Pty Ltd.

- Upstart Network, Inc.

- Lending Loop

- Prosper Funding LLC

- goPeer Corporation

- Harmoney Australia Pty Ltd

- Linked P2P Limited and more…

Peer-to-Peer (P2P) Lending Market Growth Restraint

Despite its rapid expansion, the Peer-to-Peer (P2P) lending market faces notable challenges. Key among these is the risk associated with security and fraud. As digital platforms become increasingly prevalent, the potential for data breaches and cyberattacks intensifies, raising concerns about the safety of consumer information. Investors are wary of losses due to fraudulent activities, which can undermine confidence in P2P lending platforms. Consequently, providers must invest heavily in sophisticated security measures to protect sensitive data and foster a secure lending environment. Additionally, the evolving regulatory landscape poses uncertainties, as regulatory clarity is essential for maintaining stability in the market. Therefore, while the market is poised for substantial growth, these restraints must be navigated effectively for sustained expansion.

Frequently Asked Questions (FAQs)

- What would be the estimated CAGR of the global Peer-to-Peer (P2P) lending market during 2025-2032?

- What are the key factors driving the global Peer-to-Peer (P2P) lending market during 2025-2032?

- What are the possible aspects projected to impede the further expansion of the global Peer-to-Peer (P2P) lending market through 2032?

- Who are the leading players in the global Peer-to-Peer (P2P) lending market during 2025-2032?

About US

At Report Cube, we are more than just a market research company; we are your strategic partner in unlocking the insights that drive your business forward. With a passion for data, a commitment to precision, and a dedication to delivering actionable results, we have been a trusted resource for businesses seeking a competitive edge.

Our mission is to empower businesses with the knowledge they need to make informed decisions, innovate, and thrive in an ever-evolving marketplace. We believe that data-driven insights are the cornerstone of success, and our team is dedicated to providing you with the highest quality research and analysis to help you stay ahead of the curve.

Contact US

The Report Cube

Burjuman Business Tower, Burjuman, Dubai

Phone: +971 564468112 (WhatsApp)

Email: sales@thereportcubes.com