North America Powder Dietary Supplements Market Size and Share Analysis (2025–2033)

Market Overview

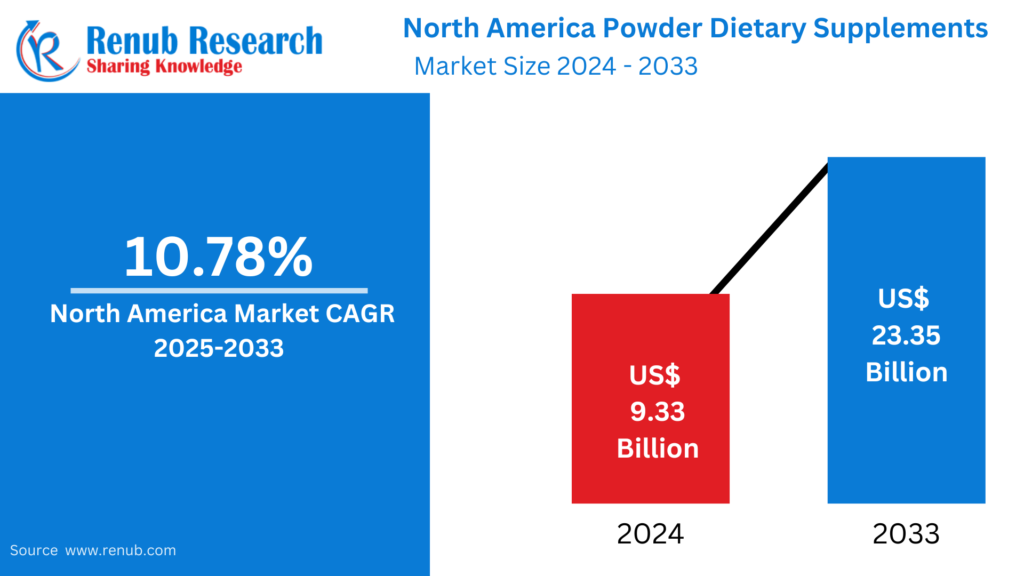

The North America powder dietary supplements market is projected to surge from USD 9.33 billion in 2024 to approximately USD 23.35 billion by 2033, growing at a CAGR of 10.78% during the forecast period. This substantial growth is propelled by rising health consciousness, demand for nutrient-dense formats, and lifestyle shifts favoring preventive wellness.

What are Powder Dietary Supplements?

Powder dietary supplements are concentrated sources of nutrients — such as vitamins, minerals, proteins, amino acids, probiotics, and herbal extracts — formulated into a powder form. These supplements are typically dissolved in liquids like water, milk, or smoothies, offering a convenient and quick-absorbing way for individuals to meet their daily nutritional needs.

Key Market Trends

- Increasing Health Awareness & Preventive Healthcare

Consumers across North America are embracing preventive health practices, leading to a higher intake of dietary supplements. Social media, influencers, and healthcare professionals are playing a pivotal role in promoting these products. Brands like Medella Springs Healthcare introduced AddiVance in 2024, a stimulant-free supplement formulated at FDA-registered, cGMP facilities, highlighting trust and safety.

- Fitness and Sports Nutrition Boom

The rising culture of fitness and gym routines has driven demand for protein powders, amino acids, and performance-boosting supplements. Products such as RSP Nutrition’s AminoLean MAX cater to consumers aiming to enhance workout efficiency and recovery, contributing to sustained market momentum.

- Product Innovation and Flavors

The market is experiencing innovation in bioavailability, formulation, and taste. From micronized powders to multi-nutrient blends and organic, non-GMO options, the evolution appeals to clean-label seekers. Flavor diversity — chocolate, berry, tropical fruits — is also enhancing consumer adoption.

Major Challenges

- Regulatory Compliance

The market is subject to strict regulatory oversight from FDA (USA) and Health Canada. Companies must comply with rigid safety, labeling, and ingredient guidelines, with non-compliance potentially leading to product recalls and reputational damage.

- Intensifying Competition

The sector faces market saturation, with multiple brands offering similar products. As a result, pricing pressure, limited customer loyalty, and brand-switching are challenges. Companies must differentiate through innovation, marketing, and strategic positioning.

Related Report

Europe Powder Dietary Supplements Market

Asia Pacific Powder Dietary Supplements Market

Segment Analysis

By Type

Vitamins

With growing awareness of micronutrient deficiencies, vitamin powders — especially Vitamin C, D, and B-complex — are gaining popularity. These supplements are preferred over tablets due to their better absorption and easy mixability.

Minerals

Key minerals such as calcium, magnesium, and zinc are vital for bone and muscle health. Consumers on plant-based or restricted diets often opt for powdered versions for convenient intake and assimilation.

Proteins and Amino Acids

This is the largest and most dynamic segment, driven by sports nutrition and muscle recovery trends. Demand for plant-based, whey, and collagen protein powders continues to rise among both men and women.

Herbal Supplements

Consumers looking for natural health boosters are turning toward ashwagandha, turmeric, and green tea extract powders, blending ancient wellness with modern convenience.

Fatty Acids

While less dominant, omega-rich powders (like flaxseed or algae-based) are gaining ground due to cardiovascular and brain health benefits.

Probiotics

As gut health becomes central to well-being, probiotic powders are emerging fast. Non-dairy, shelf-stable options are especially popular among lactose-intolerant or vegan consumers.

Other Types

Includes antioxidant blends, electrolytes, detoxifying formulas, and niche superfoods like spirulina and moringa.

By Distribution Channel

Supermarkets/Hypermarkets

These channels offer convenient access and wide product variety, often combined with attractive discounts. They are vital for mainstream consumer engagement.

Pharmacies and Drug Stores

Trusted by medical professionals and consumers alike, pharmacies stock highly vetted and clinically recommended powder supplements.

Convenience/Grocery Stores

The rise of impulse wellness buying and everyday health integration is increasing supplement presence in grocery stores.

Online Retail Stores

E-commerce is a booming channel, providing personalized recommendations, subscription models, and access to niche brands. Platforms like Amazon, iHerb, and brand-specific websites dominate.

Other Distribution Channels

Includes direct-to-consumer, MLM models, and wellness boutiques.

Country-wise Analysis

United States

The U.S. is the largest market, backed by high health literacy, innovation, and robust manufacturing infrastructure. Personalization, botanical blends, and direct-to-consumer wellness startups drive the market forward.

🆕 Medella Springs’ launch of AddiVance in Feb 2024 highlights the U.S.’s advanced and regulated approach to stimulant-free, condition-specific formulations.

Canada

Strong government-backed wellness initiatives, strict regulatory compliance (via Health Canada), and growing preference for organic and plant-based supplements drive the Canadian market.

🌿 Oct 2024: Fruit d’Or’s launch of Blue d’Or™ Vitality — a cranberry and blueberry antioxidant powder — indicates Canada’s focus on clean-label and nutraceutical innovations.

Mexico

The Mexican market is fueled by urbanization, rising incomes, and increased supplement access via e-commerce and health food retailers. Youth interest in sports nutrition also plays a crucial role.

🇲🇽 2023: Kyowa Hakko expanded into Mexico, leveraging the rising demand for dietary and performance-focused supplements.

Key Questions Answered

- What is the market size of the North America Powder Dietary Supplements Market in 2024?

- USD 9.33 billion.

- What is the projected value of this market by 2033?

- USD 23.35 billion.

- What is the expected CAGR during 2025–2033?

- 10.78%.

- Which segments are witnessing the fastest growth?

- Probiotics, protein powders, and vitamin supplements.

- Which distribution channel leads the market?

- Supermarkets/hypermarkets and online retail.

- What factors are driving growth?

- Health awareness, sports nutrition, and preventive healthcare trends.

- What are the key market challenges?

- Regulatory hurdles and market saturation.

- Which country dominates the North American market?

- United States.

- What are consumers seeking in product innovation?

- Better absorption, clean-label ingredients, and unique flavors.

- How is the e-commerce sector influencing the market?

- By offering broader access, personalization, and consumer convenience.