Market Overview

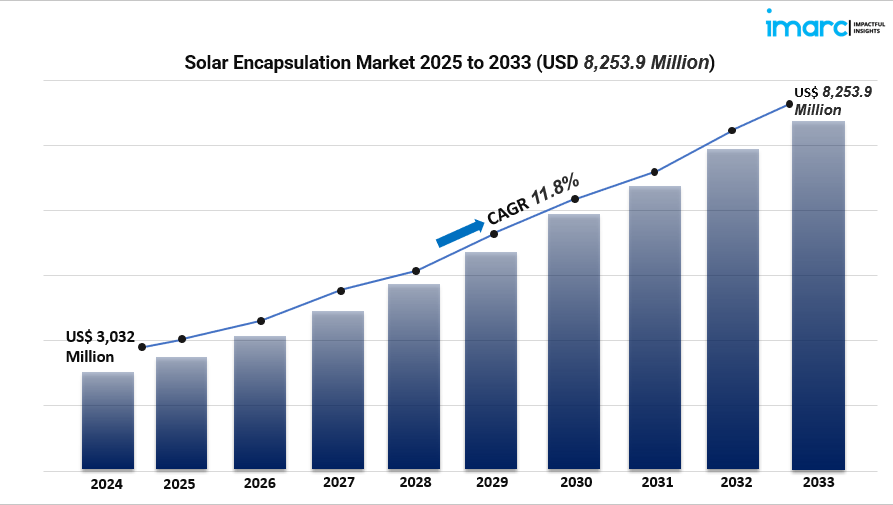

The global solar encapsulation market reached USD 3,032 million in 2024 and is projected to surge to USD 8,253.9 million by 2033, growing at a CAGR of 11.8%. Expanding solar installations, advanced encapsulant technologies, and strict clean-energy regulations drive this growth. Enhanced materials prolong panel lifespan and efficiency in challenging conditions, supporting the market’s positive trajectory.

Study Assumption Years

- Base Year: 2024

- Historical Year(s): 2019–2024

- Forecast Year(s): 2025–2033

Solar Encapsulation Market Key Takeaways

- Market Size & Growth: Valued at USD 3,032 M in 2024 and set to reach USD 8,253.9 M by 2033, at an 11.8% CAGR .

- Regional Leadership: Asia Pacific commands over 60.2% of the market share in 2024 .

- Preferred Material: Ethylene Vinyl Acetate (EVA) dominates with an ~82.7% share .

- Leading Technology: Single-crystal/polycrystalline silicon accounts for ~89.7% of the market .

- Top Application: Construction sector leads with ~48.2% share .

- Tech Trends: Bifacial panels like Vikram Solar’s HJT modules boost demand.

- Supportive Policies: Government incentives and clean-energy regulations significantly power market expansion .

Market Growth Factors

Technological Advancements in Encapsulant Materials

Advanced innovations in encapsulants are crucial for driving market growth. EVA films are still the frontrunners, holding about 82.7% of the market share thanks to their excellent adhesion, thermal stability, and resistance to moisture and UV rays. At the same time, the emergence of non-EVA alternatives—like UV-curable resins, thermoplastic polyurethane (TPU), and polyvinyl butyral (PVB)—is meeting the increasing demand for eco-friendly and more durable options. These materials are perfect for the next generation of solar modules, including bifacial and heterojunction panels, which need strong encapsulation to ensure they perform efficiently and last under pressure.

Regulatory & Governmental Support

Governments around the globe are supporting market growth with incentives and regulations. In the U.S., the Department of Energy’s $40 million investment and the Investment Tax Credit (ITC) are boosting the resilience of the PV supply chain and the use of encapsulants. In Europe, cutting the VAT on solar PV installations has encouraged more homeowners to adopt solar energy. Meanwhile, countries in the Asia Pacific, like India and China, are setting ambitious renewable energy goals, with India planning to add 24.5 GW of solar capacity in 2024. These initiatives are driving up the demand for encapsulants, which in turn promotes the development of energy-efficient and long-lasting solar modules.

Rising Solar Adoption & Infrastructure Development

The rising global demand for electricity, coupled with a commitment to sustainability, is propelling solar installations. According to the IEA, global electricity demand is expected to grow by about 2.1% each year until 2040. Developers are increasingly turning to bifacial and high-efficiency modules, which require encapsulants that can withstand heat, moisture, and UV stress. Investments in large-scale solar projects and green buildings—especially in the construction sector of the Asia Pacific, which holds a 48.2% market share—are further driving the need for encapsulation materials. This connection between energy demand and clean energy goals is supporting ongoing market growth.

Request for a sample copy of this report: https://www.imarcgroup.com/solar-encapsulation-market/requestsample

Market Segmentation

By Material:

- Ethylene Vinyl Acetate: Proven, adhesive, and durable encapsulant (82.7%)

- Non-Ethylene Vinyl Acetate

- UV Curable Resins

By Technology:

- Single-crystal/polycrystalline silicon solar technology: Leading (~89.7%)

- Thin-film Solar Technology:

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide (CIGS)

- Amorphous Silicon (a‑Si)

By Application:

- Construction: Integrates panels in buildings (48.2%)

- Electronics

- Automotive

- Others

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Regional Insights

The Asia Pacific region is set to lead the market, capturing more than 60.2% by 2024. The surge in solar installations in countries like China, India, and Japan—driven by ambitious renewable energy goals and supportive government policies—has significantly boosted the demand for high-quality encapsulants. India, for instance, is expected to add 24.5 GW of solar capacity in 2024 and aims for a remarkable 500 GW of non-fossil energy by 2030, showcasing its strong growth trajectory.

Recent Developments & News

Several key developments are shaping the solar encapsulation landscape:

- Vikram Solar launched its SURYAVA bifacial HJT module on August 13, 2024, achieving over 23% efficiency and highlighting the demand for advanced encapsulants .

- U.S. DOE invested USD 40 million on September 12, 2024, focusing on PV longevity, recycling, and manufacturing—efforts poised to enhance encapsulant demand .

- Europe implemented VAT reductions on solar PV in early 2022, lowering costs and fueling residential solar uptake, thereby expanding the market for high-performance encapsulants .

Key Players

- 3M Company

- Bridgestone Corporation

- dnpSolar (Dai Nippon Printing Co., Ltd.)

- Dow Inc.

- Dupont De Nemours Inc.

- Eastman Chemical Company

- First Solar Inc.

- Kuraray Co. Ltd.

- Mitsubishi Chemical Holdings Corporation

- Mitsui Chemicals Inc.

- RenewSys India Pvt. Ltd.

- STR Holdings Inc.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=4988&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145