When people think of borrowing, the first thought is often about handling emergencies or meeting standard financial needs. Yet in today’s dynamic landscape, Loans can be much more than that; they can act as catalysts that bring unconventional ideas to life. From doctors experimenting with new ways of delivering healthcare to entrepreneurs breaking ground in niche industries, access to the right financing can unlock opportunities that go beyond the ordinary.

Understanding how borrowing supports not just necessity but also innovation reveals its true potential as a tool for progress:

Funding medical innovation

For healthcare professionals, opportunities are expanding well beyond traditional clinic practice. Many doctors today are setting up diagnostic centres with AI-enabled technology, investing in telemedicine platforms, or establishing wellness spaces that combine modern science with preventive care.

A Doctor Loan provides the capital required for these ambitious projects, covering costs such as advanced equipment, facility upgrades, or research collaborations. By supporting such initiatives, lending enables professionals to improve patient care and change the future of medicine.

Empowering unconventional businesses

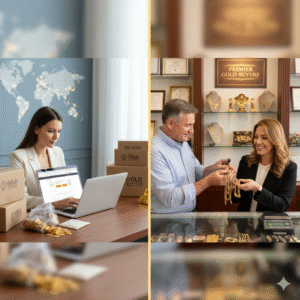

Entrepreneurs are no longer restricted to mainstream ventures. Innovative businesses are emerging in areas such as eco-friendly consumer products, experiential travel, digital learning, and even virtual art exhibitions. Access to funding through an Online Business Loan helps these enterprises turn unique concepts into reality.

Digital platforms make the process smoother. Applications are quick, paperwork is minimal, and disbursal often happens directly into the Business Account. This efficiency enables entrepreneurs to focus their energy on refining their ideas rather than getting bogged down in administrative hurdles.

The broader value of thinking differently

- Capital for creativity: Great ideas often fail without adequate funding. Borrowing bridges the gap between vision and execution.

- Speed of access: Online platforms ensure innovators can seize opportunities at the right time, without losing momentum.

- Versatile use: Loans can finance research, product development, digital campaigns, or international partnerships, depending on the need.

Balancing risk and growth

While unconventional projects are exciting, they can also carry higher risks. A niche business idea may take longer to generate returns, and innovative healthcare services may require patience before gaining acceptance. This makes responsible borrowing essential. Tools like calculators for EMI planning help professionals and business owners forecast cash flows, align repayment schedules with expected revenues, and reduce financial stress.

Disciplined repayment safeguards credit profiles, ensuring that future borrowing remains accessible when needed.

Conclusion

Borrowing, when approached thoughtfully, is not a limitation but a launchpad for growth. It enables professionals and entrepreneurs to chase ideas that might once have seemed out of reach. By combining innovative thinking with structured financial support, it becomes possible to fuel creativity, drive progress, and achieve aspirations that go far beyond the ordinary.