UK Financial Services Market Overview

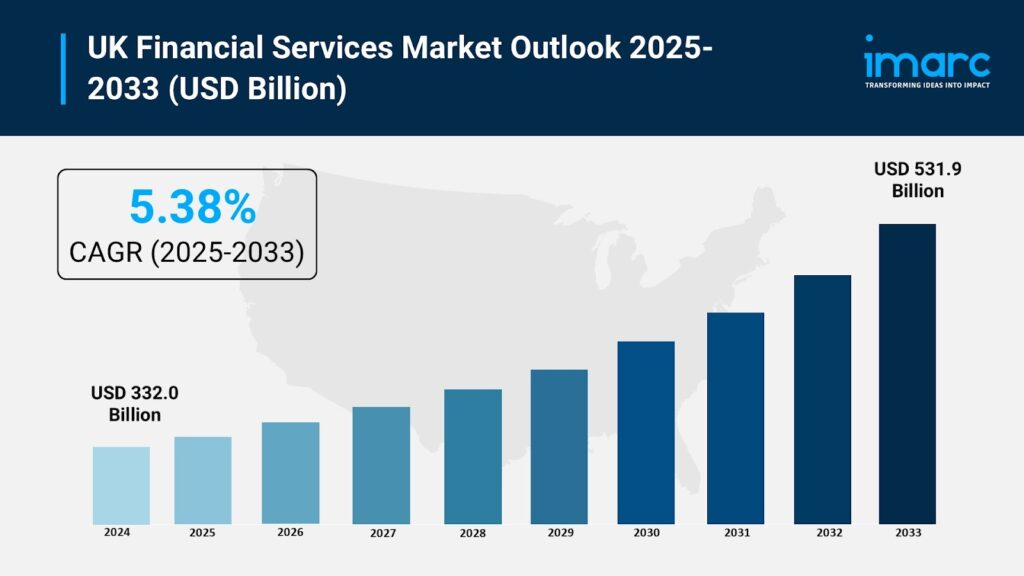

Market Size in 2024: USD 332.0 Billion

Market Forecast in 2033: USD 531.9 Billion

Market Growth Rate (CAGR 2025–2033): 5.38%

According to the latest report by IMARC Group, the UK financial services market reached USD 332.0 Billion in 2024. Looking forward, the market is projected to reach USD 531.9 Billion by 2033, exhibiting a CAGR of 5.38% during 2025–2033.

The market is a key contributor to the UK economy, driven by robust banking, asset management, and insurance segments. Furthermore, shifting consumer preferences, increasing digitalization, and a strict regulatory framework are further propelling market growth, offering opportunities for service providers to innovate and expand their offerings.

UK Financial Services Market Trends and Drivers

Regulatory Support and Digital Transformation Are Driving Market Growth

The UK financial services market is growing steadily due to regulatory backing and digital change. Government policies promote transparency. They protect consumers and ensure stability in banking, insurance, and investment services. Financial institutions are using digital tools. These include mobile banking, AI tools, and blockchain systems. They boost efficiency, lower risks, and enhance customer experiences. Fintech services are improving traditional banking. They offer new lending, payment, and wealth management options for both individuals and businesses. Digital wallets, online payment gateways, and contactless systems are growing. This rise boosts the need for modern financial infrastructure. It also promotes financial inclusion for many groups. Banks and insurers are investing in secure, scalable tech platforms. They aim to meet changing regulations, cut fraud risks, and boost their operations.

Market players are now focusing on customer-centered strategies. They want to meet changing consumer preferences. Demand for personalized services and user-friendly digital tools is growing. Institutions are turning to data analytics, AI, and machine learning for tailored solutions. They want clear product offerings to meet these needs. Investing in cybersecurity and data protection builds trust. This, in turn, encourages people to adopt digital financial products. Collaboration between banks and fintech startups is boosting innovation. It helps them reach more customers and creates a lively ecosystem for growth. Regulatory bodies are making changes by simplifying licensing. They are also improving oversight and offering incentives for digital use.

These factors include:

- Expanding market access

- Increasing efficiency

- Strengthening the UK’s role as a top global financial hub

Banking, insurance, and investment segments are boosting market expansion.

The UK financial services market is booming. Banking, insurance, and investment sectors lead the way in revenue. Digitalization is improving lending and payment services. This means faster and more efficient transactions for both consumers and businesses. The insurance sector is changing. It offers custom policies, digital claims, and predictive risk tools. This shift meets the growing need for better coverage and convenience. Asset management and investment services are increasingly using automated advisory solutions. This includes robo-advisors and algorithmic trading. These tools aim for better returns and improved portfolio management. Foreign exchange and reinsurance help market growth. They support trade, manage risk, and boost cross-border finance. Ongoing tech adoption and rising investor confidence are helping financial institutions. They can now scale operations, cut costs, and expand their services as the economy recovers.

Financial literacy programs and increased consumer awareness are driving the use of various financial products. People and businesses are exploring investment options, insurance plans, and new banking solutions. They want to boost financial security and reach their long-term goals. Banks are combining physical branches with digital services to enhance accessibility and efficiency. Insurance and investment firms offer easy-to-use platforms and apps. These tools help with product selection, claims processing, and managing portfolios. These efforts attract new clients and keep current ones. This drives steady revenue growth. Public entities and private firms are working together. This partnership strengthens financial infrastructure, ensures compliance, and drives technology forward. All these factors are key for market development.

Consumer Trends, Technology Adoption, and Strategic Initiatives Expanding Market Share

The UK financial services market is growing. Consumer trends, tech adoption, and strategic plans are changing the scene. More people want safe and easy financial solutions. So, institutions are investing in digital platforms, mobile apps, and AI analytics. Providers are using cloud computing, big data, and blockchain. These tools help them work faster, make real-time transactions, and lower costs. They also ensure compliance. The rise of environmental, social, and governance (ESG) factors is changing how people invest. Managers are building sustainable and socially responsible portfolios to meet new investor needs. Strategic partnerships, mergers, and acquisitions help institutions diversify. They enter new markets and expand their reach.

The market is also benefiting from more fintech solutions. These include digital lending, peer-to-peer payment platforms, and online wealth management tools. Startups are teaming up with established banks. They aim to create products, improve tech use, and boost customer experiences. Retail and corporate banking use AI chatbots, automated risk assessment, and predictive analytics. These tools help them run operations smoothly and provide personalized services. Financial education programs are boosting participation. They help people and businesses make smarter choices. These trends boost revenue growth and improve market access. They help the UK financial services sector stay important for economic development. This shows resilience and innovation in a digital financial world.

Download sample copy of the Report: https://www.imarcgroup.com/uk-financial-services-market/requestsample

Key growth factors include:

- Banking & Lending Innovations: Adoption of digital banking platforms and payment solutions.

- Insurance & Risk Management: Growth in reinsurance, brokerage services, and insurance products.

- Investment & Wealth Management: Rising demand for investment services from both retail and institutional investors.

- Foreign Exchange Services: Increased cross-border trade and remittances driving FX services.

- Digitalization & Technology: FinTech solutions enabling seamless service delivery and customer engagement.

- Regulatory Compliance: Strong regulatory framework ensuring financial stability and transparency.

UK Financial Services Market Segmentation

Type Insights:

- Lending and Payments

- Insurance

- Reinsurance and Insurance Brokerage

- Investments

- Foreign Exchange Services

A detailed analysis of the market based on service type is included.

Size of Business Insights:

- Small and Medium Business

- Large Business

A detailed analysis of the market based on the size of business is provided.

End-User Insights:

- Individuals

- Corporates

- Government

- Investment Institution

A detailed analysis of the market based on end-users is provided.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report provides forecasts at the regional level, covering all major UK regions.

Competitive Landscape

The report examines the competitive landscape of the industry, profiling key players, their market share, strategic initiatives, and service offerings in the UK.

Key Highlights of the Report:

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Competitive Landscape Mapping

Note: Customized insights can be provided for specific business or research requirements.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24809&flag=C

About Us

IMARC Group is a global management consulting firm helping ambitious changemakers create lasting impact. Our services include market assessment, feasibility studies, regulatory approvals, company incorporation support, factory setup assistance, branding, competitive benchmarking, pricing, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

📧 Email: sales@imarcgroup.com

📞 Tel No (D): +91 120 433 0800

📞 United States: +1-201-971-6302