Market Overview

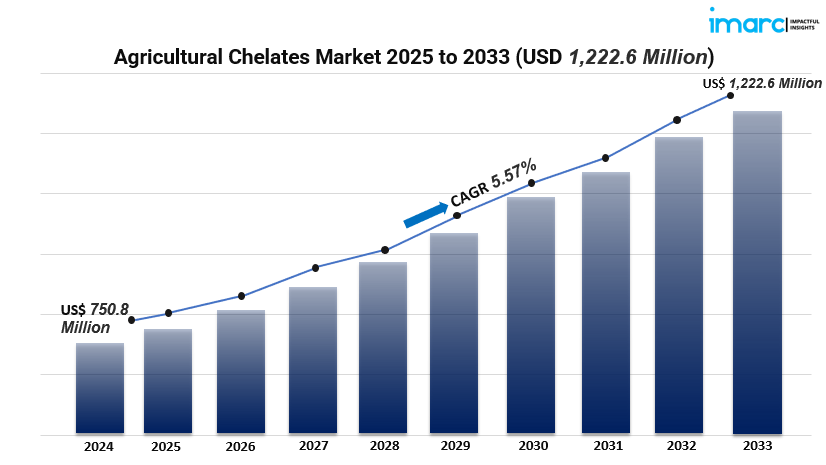

The global agricultural chelates market was valued at USD 750.8 million in 2024 and is projected to reach USD 1,222.6 million by 2033, growing at a CAGR of 5.57% from 2025 to 2033. This growth is driven by the increasing demand for high-efficiency fertilizers, heightened awareness of sustainable agricultural practices, significant technological advancements in chelation chemistry, and favorable government initiatives supporting the agricultural sector. The rising global population and subsequent food demand further propel the need for efficient nutrient delivery systems in agriculture.

Study Assumption Years

- Base Year: 2024

- Historical Year: 2019–2024

- Forecast Year: 2025–2033

Agricultural Chelates Market Key Takeaways

- Market Size & Growth: The market size reached USD 750.8 million in 2024 and is expected to grow to USD 1,222.6 million by 2033, with a CAGR of 5.57%.

- Dominant Region: Asia Pacific leads the market, driven by a rapidly growing agricultural sector and favorable government initiatives.

- Synthetic Chelates: Synthetic chelates, particularly EDTA, dominate the market due to their stability and cost-effectiveness.

- Foliar Application: The foliar application segment holds the largest market share, offering efficient nutrient delivery.

- Crop Type: Grains and cereals account for the largest share, emphasizing their importance in global food security.

- Technological Advancements: Significant innovations in chelation chemistry enhance nutrient availability and absorption.

- Sustainable Practices: Growing adoption of sustainable agricultural practices boosts the demand for agricultural chelates.

Market Growth Factors

- Rising Demand for High-Efficiency Fertilizers

The global agricultural sector is under increasing pressure to boost crop yields and improve quality, driven by a rising population and the scarcity of arable land. To meet this challenge, high-efficiency fertilizers, particularly chelates, play a crucial role. Chelates enhance the availability and absorption of key micronutrients like zinc, manganese, and iron, which are essential for healthy plant growth and productivity. Unlike traditional fertilizers, chelates help minimize nutrient loss through processes like volatilization, soil fixation, and leaching, ultimately optimizing crop yields while reducing environmental harm.

- Technological Advancements in Chelation Chemistry

Recent technological breakthroughs in chelation chemistry have resulted in the creation of more effective and stable chelating agents. Innovations such as biodegradable chelates and formulations designed for specific crops and soil types improve nutrient availability and absorption. These advancements not only lead to higher crop yields and better-quality produce but also align with the increasing demand for sustainable agricultural practices by lessening environmental impact.

- Government Initiatives Supporting Sustainable Agriculture

Around the globe, governments are rolling out supportive policies and initiatives to encourage sustainable farming. These efforts include subsidies for adopting efficient nutrient delivery systems, grants for research and development in innovative agricultural technologies, and regulations that promote the use of eco-friendly inputs. Such initiatives are vital for the growth of the agricultural chelates market, making advanced nutrient solutions more accessible to farmers and fostering sustainable farming practices.

Request for a sample copy of this report: https://www.imarcgroup.com/agricultural-chelates-market/requestsample

Market Segmentation

- Breakup by Type:

- Synthetic:

- EDTA (Ethylenediaminetetraacetic Acid): Widely used for its stability and effectiveness in various soil conditions.

- EDDHA (Ethylenediamine-N,N’-bis (2-Hydroxyphenylacetic Acid)): Preferred for alkaline soils due to its superior performance.

- DTPA (Diethylenetriamine Pentaacetate): Effective in slightly alkaline to neutral soils.

- IDHA (Imidodisuccinic Acid): Emerging chelate with environmental benefits.

- Others: Includes HEDP, HETDA, organic acids, and NTA.

- Organic:

- Lignosulfonates: Derived from wood pulp, offering biodegradable properties.

- Amino Acids: Enhance plant growth and stress resistance.

- Heptagluconates: Known for their high stability and effectiveness.

- Others: Includes various natural chelating agents.

- Synthetic:

- Breakup by Crop Type:

- Grains and Cereals: Dominant segment, including rice, wheat, and corn.

- Pulses and Oilseeds: Important for protein and oil production.

- Commercial Crops: Includes cotton and tobacco.

- Fruits and Vegetables: High-value crops with significant market demand.

- Turf and Ornamentals: Niche market focusing on aesthetics and landscaping.

- Breakup by Application:

- Soil: Direct application to soil to enhance nutrient availability.

- Foliar: Application to plant leaves for rapid nutrient uptake.

- Fertigation: Integration of fertilizers into irrigation systems.

- Others: Includes seed treatment and trunk injection.

- Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Regional Insights

The Asia Pacific region is leading the way in the agricultural chelates market, holding a significant revenue share of 37.4% in 2023. This strong position is largely due to the increasing population in the area and the ongoing need to boost agricultural productivity to satisfy the growing food demand. Farmers here are embracing modern farming techniques more than ever, including the use of chelates to tackle micronutrient shortages and enhance plant growth.

Recent Developments & News

- ICL Group’s Biodegradable Chelate: In July 2023, ICL Group introduced a biodegradable chelate with demonstrated bioactivity. This innovative technology not only delivers an average yield increase of 2.5 bags per hectare in soybean cultivation, compared to traditional chelating agents, but also ensures biodegradability in the soil and exhibits a notable physiological effect.

- Nouryon’s Acquisition of ADOB: In January 2023, Nouryon, a global leader in specialty chemicals, acquired ADOB, a major supplier of chelated micronutrients, fertilizers, and specialized agricultural solutions in Poland. This strategic acquisition enhances Nouryon’s diverse crop nutrition portfolio and reinforces its commitment to the agriculture and food sector, allowing the company to expand its range of services and products for industry customers.

- Croplands and Robotics Plus Partnership: In March 2024, Croplands and Robotics Plus partnered to launch Prospr, an innovative spray equipment platform, into the horticulture sector in Australia and New Zealand. This collaboration aims to enhance the efficiency and effectiveness of pesticide and fertilizer applications in horticultural crops.

Key Players

- Akzo Nobel N.V.

- Aries Agro Ltd

- BASF SE

- Dow Inc.

- Haifa Negev Technologies Ltd.

- Mitsubishi Chemical Corporation

- Nouryon

- Nufarm Limited

- Protex International SA

- The Andersons Inc

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5596&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145