Diesel Generator Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

Market Overview

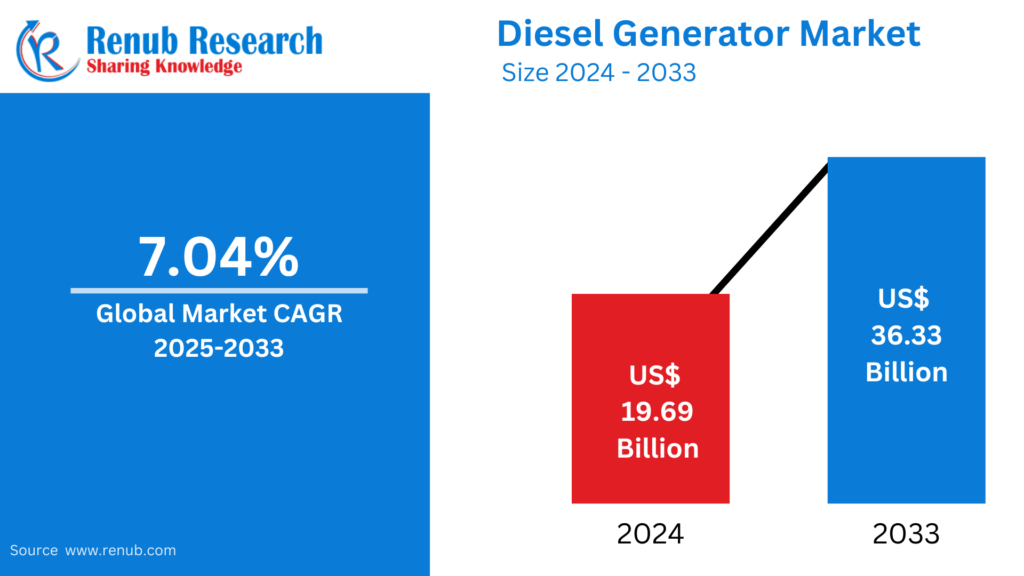

The global diesel generator market reached a value of USD 19.69 billion in 2024 and is projected to grow at a CAGR of 7.04% during 2025–2033, reaching USD 36.33 billion by 2033. This steady growth is driven by factors such as the rising demand for uninterrupted power supply, increasing industrialization, remote infrastructure development, and reliance on diesel gensets for reliable backup power.

Diesel generators (gensets) serve as critical power backup systems in healthcare, data centers, manufacturing plants, telecommunications, residential buildings, and off-grid areas like mining and oil exploration sites. Their reliability, fuel efficiency, and durability have positioned them as indispensable components of global energy solutions.

Market Segmentation

By Portability

- Stationary Diesel Generators

- Portable Diesel Generators

By Power Rating

- ≤ 50 kVA

- 50 kVA – 125 kVA

- 125 kVA – 200 kVA

- 200 kVA – 330 kVA

- 330 kVA – 750 kVA

- 750 kVA

By Application

- Standby

- Peak Shaving

- Prime/Continuous

By End User

- Residential

- Commercial

- Industrial

By Region/Country

- United States

- United Kingdom

- India

- Saudi Arabia

- Rest of the World

Key Market Drivers

🔌 Need for Reliable Backup Power

Rising demand from critical sectors like hospitals, data centers, and factories for continuous power is a major growth driver. The increasing adoption of smart systems and digital infrastructure adds pressure on stable electricity supply.

🏗️ Urbanization & Infrastructure Boom

Rapid urban expansion and megaprojects across developing nations have amplified the demand for gensets in construction, transportation, and commercial hubs.

☀️ Support for Renewable Integration

As renewables like wind and solar are intermittent, diesel generators act as stable backups. Hybrid systems combining diesel gensets with renewables are gaining popularity, especially in off-grid areas.

Related Report

United States Biodiesel Market

Key Market Challenges

🌍 Strict Emission Norms

Diesel engines are carbon-intensive, and global emission regulations are pushing manufacturers to invest in cleaner, low-emission genset technologies, which increases production costs.

💰 Volatility in Diesel Prices

Fluctuating global crude oil prices impact the operational costs of diesel gensets, making them less appealing compared to greener or gas-based alternatives.

Segment Highlights

🔋 Portable Diesel Generator Market

Increasingly used in construction sites, agriculture, and emergency settings due to ease of transport and setup. Newer models focus on fuel-efficiency and reduced emissions.

⚙️ 125 kVA – 200 kVA Gensets

Ideal for medium-scale operations, especially in manufacturing, telecom, and healthcare sectors. These gensets offer a balance of performance and efficiency, especially in power-scarce regions.

⚡ Standby Diesel Generator Market

Growing due to natural disasters and power infrastructure failures. High demand in data centers, hospitals, and industrial facilities seeking uninterrupted operations.

🏠 Residential Diesel Generator Market

Residential users adopt diesel gensets for backup during grid failures, especially in rural or disaster-prone areas. Compact models with low noise and emissions are gaining traction.

Regional Market Insights

🇺🇸 United States

- Frequent weather-related power outages and aging infrastructure drive demand.

- High adoption in data centers, healthcare, and manufacturing.

- October 2024: Baudouin introduced gensets tailored for data centers.

🇬🇧 United Kingdom

- Diesel gensets complement renewable energy sources in commercial setups.

- Increasing use in events, infrastructure projects, and hospitals.

- May 2024: Trime launched a new genset line powered by Kohler Stage V, Yanmar, FPT Iveco, and Perkins.

🇮🇳 India

- Rapid industrialization and unreliable grid connectivity in rural areas boost demand.

- Gensets are widely used in telecom, healthcare, and irrigation.

- March 2024: Recon Technologies launched CPCBIV+ compliant diesel generators with Mahindra Powerol.

🇸🇦 Saudi Arabia

- Growth driven by NEOM and other mega infrastructure projects.

- Oil & gas operations in remote regions rely heavily on gensets.

- December 2024: Tide Power delivered three 413kVA diesel gensets to a key client.

Future Outlook

The diesel generator market will continue to grow as industries and households seek reliable power amid increasing outages, rising electrification, and renewable transitions. However, emission regulations and fuel price volatility will challenge traditional diesel technologies, pushing the industry toward hybrid and cleaner innovations.

10 Key Questions This Report Answers

- What is the market size of the global diesel generator industry in 2024?

- At what CAGR is the diesel generator market expected to grow between 2025 and 2033?

- Which power rating segment is expected to dominate the market?

- What role do diesel gensets play in renewable hybrid energy systems?

- What are the major drivers of the portable diesel generator segment?

- Which regions offer the highest growth potential for diesel gensets?

- How are emission regulations impacting diesel generator production?

- What is the market outlook for standby diesel generators?

- How are emerging economies like India contributing to market growth?

- What technological innovations are shaping the future of diesel gensets?