Fintech chatbots are changing the way people interact with financial services. They make it easier for users to check their bank balance, ask about a loan, or even invest money—all through a simple chat interface.

In this blog post, we’ll explain what fintech chatbots are, how they work, and why they matter. Let’s dive in.

What Is a Fintech Chatbot?

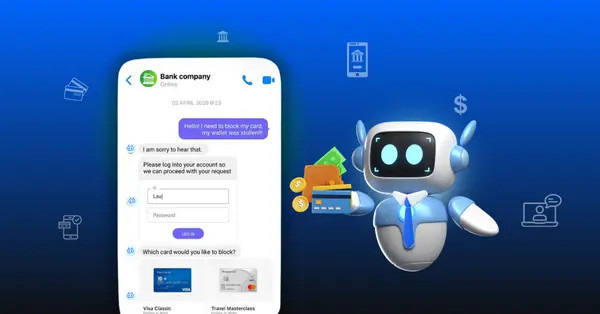

A fintech chatbot is a software program that uses artificial intelligence (AI) to talk to people. It lives inside apps, websites, or messaging platforms like WhatsApp, Facebook Messenger, or a bank’s mobile app.

These bots help users perform financial tasks through chat. Some common tasks include:

-

Checking bank account balance

-

Transferring money

-

Asking about loan offers

-

Getting investment advice

-

Reporting a lost card

These bots act like digital assistants for your finances. Instead of calling a bank or waiting in line, users just type their question—and the bot replies instantly.

Why Are Chatbots Used in Fintech?

The fintech world is all about speed, convenience, and automation. That’s where chatbots shine.

Here are a few reasons why fintech companies use chatbots:

24/7 Customer Support

Bots never sleep. They answer customer questions any time of day, even on weekends.

Cost-Effective

A chatbot can handle thousands of chats at once. That saves companies money on customer support.

Faster Response Time

Users don’t like to wait. Chatbots respond instantly, improving user experience.

Personalized Service

Many bots use past data to offer personalized tips, reminders, or financial advice.

Fewer Human Errors

Chatbots follow rules and workflows. They don’t make mistakes like humans might.

How Do Fintech Chatbots Work?

At a basic level, fintech chatbots combine three key technologies:

Natural Language Processing (NLP)

NLP helps the bot understand human language. It breaks down the user’s message and finds the intent.

Example:

If someone types “How much money do I have?”, the bot understands they want their account balance.

Machine Learning (ML)

ML helps the bot get smarter over time. It learns from past chats and improves its replies.

Backend Integration

This allows the bot to connect with a bank’s system. It pulls real-time data like balance info, loan offers, or transaction history.

Let’s look at an example:

Example of a Fintech Chatbot in Action

User: “Hi, what’s my current balance?”

Chatbot: “Hi Sarah! Your checking account balance is $1,250.43.”

User: “Can I transfer $500 to James?”

Chatbot: “Sure! Confirm the last 4 digits of your card to proceed.”

User: “1234”

Chatbot: “Done! $500 has been sent to James.”

This is just a simple flow. Behind the scenes, the chatbot:

-

Understood the message

-

Verified the user

-

Connected with the bank’s system

-

Made the transfer

-

Confirmed the action

All of this happened in seconds—without human help.

Types of Fintech Chatbots

There are different kinds of chatbots used in fintech:

Customer Support Bots

These help answer FAQs like “What are your working hours?” or “How do I reset my PIN?”

Transactional Bots

These bots allow users to send money, pay bills, or check transactions.

Advisory Bots

Also known as robo-advisors, these offer investment advice based on user goals and risk level.

Fraud Detection Bots

These bots alert users of suspicious activities. They ask for confirmation and help secure accounts.

Benefits of Using Fintech Chatbots

Let’s look at how these bots help both companies and users:

For Fintech Companies:

-

Lower support costs

-

Higher customer satisfaction

-

Faster onboarding for new users

-

More data to improve services

For Customers:

-

24/7 instant help

-

Easier access to financial tools

-

No long calls or complex apps

-

More control over their money

Common Platforms for Fintech Chatbots

Many fintech chatbots development services work across platforms. Here are a few common ones:

-

Mobile Banking Apps

-

Company Websites

-

WhatsApp

-

Facebook Messenger

-

SMS (Text Messaging)

Some fintech companies also use voice assistants like Alexa or Google Assistant to interact with users.

Are Fintech Chatbots Safe?

Yes—if they’re built correctly.

Security is a top priority in fintech. Chatbots use end-to-end encryption to keep chats private. They also follow strict rules like:

-

Two-factor authentication (2FA)

-

Secure logins

-

Data protection laws (like GDPR)

Still, users should avoid sharing full passwords or sensitive data in chat.

Examples of Fintech Chatbots

Many big names use chatbots today. Here are a few:

-

Erica by Bank of America – Helps users track spending and manage bills

-

Eno by Capital One – Sends alerts and tracks purchases

-

Cleo – A fun, AI chatbot that helps users budget and save

-

Kasisto’s KAI – Used by banks to provide smart, conversational banking

Even smaller fintech startups now use custom bots to serve users better.

Challenges of Fintech Chatbots

Despite all the benefits, chatbots still face some challenges:

-

They may misunderstand complex questions

-

Some users prefer talking to a real person

-

Bots need regular updates to stay smart

-

Building a secure and compliant bot takes time

But with better AI and design, these issues are slowly getting solved.

The Future of Fintech Chatbots

Fintech chatbots will only get smarter in the future. We’ll see bots that:

-

Offer better financial advice

-

Help people invest with confidence

-

Detect fraud in real-time

-

Understand voice commands better

-

Speak multiple languages

As AI improves, these bots will become more like personal financial assistants.

Final Thoughts

Fintech chatbots are powerful tools. They save time, reduce costs, and improve customer service. Whether you’re a user or a fintech business, these bots offer real value.

If you’re in fintech and haven’t explored chatbots yet, now’s the time. The future of finance is conversational.