Introduction

The cryptocurrency industry is growing at an unprecedented rate, and crypto exchanges play an important part in that development. The need for sophisticated, safe, and effective trading systems is greater than ever as 2025 approaches. Crypto exchanges have evolved from simple digital asset markets to complex financial ecosystems with AI-driven automation, decentralized finance (DeFi) integration, and cutting-edge security features. s.

The evolution of cryptocurrency exchanges is being influenced by both innovation and compliance in the face of expanding institutional engagement, regulatory scrutiny, and user expectations. Whether you’re an investor, trader, or entrepreneur, recognizing these developing trends is critical for remaining competitive.

This essay digs into the most important trends and developments in cryptocurrency exchange development in 2025. We will look at the importance of blockchain, AI, decentralized exchanges, and regulatory compliance, as well as the critical role of cryptocurrency exchange development businesses in driving this revolution.

The Growing Demand for Crypto Exchange Development

Increasing Global Adoption of Cryptocurrencies

Cryptocurrencies are no longer a niche asset class; they are gaining mainstream acceptance worldwide. More businesses, governments, and financial institutions are incorporating digital currencies into their operations. This surge in adoption fuels the demand for robust, scalable, and compliant crypto exchanges.

Institutional Investors Entering the Crypto Market

The entry of institutional investors into the crypto space has significantly boosted market liquidity and credibility. Hedge funds, venture capital firms, and large corporations are actively investing in digital assets, increasing the need for professional-grade exchange platforms with institutional-grade security and compliance features.

The Role of Crypto Exchange Development Companies

A crypto exchange development company plays a pivotal role in shaping the future of trading platforms. These companies provide comprehensive crypto exchange development services, including custom-built trading engines, liquidity solutions, security protocols, and compliance frameworks. Their expertise ensures that new exchanges meet industry standards and regulatory requirements while delivering a seamless user experience.

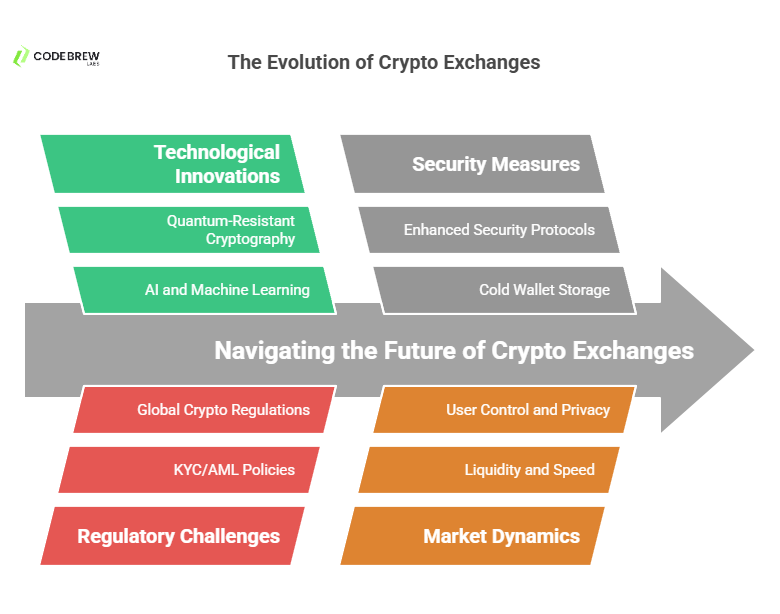

Key Trends Shaping Crypto Exchange Development in 2025

1. The Rise of Decentralized Exchanges (DEXs)

Decentralized exchanges are becoming increasingly popular due to their enhanced security, user control over funds, and reduced risk of hacking. Unlike centralized exchanges, DEXs operate on blockchain-based smart contracts, eliminating the need for intermediaries.

2. Hybrid Crypto Exchanges: The Best of Both Worlds

A new generation of hybrid cryptocurrency exchanges is forming, combining the security and control of DEXs with the liquidity and speed of centralized exchanges. With this innovation, customers may select between classic order-book models and peer-to-peer trading.

3. Regulatory-Compliant Crypto Exchanges

Regulatory scrutiny is tightening, prompting exchanges to adopt stringent compliance measures such as KYC (Know Your Customer) and AML (Anti-Money Laundering) policies. Exchanges that comply with regulations will attract more institutional investors and gain wider market acceptance.

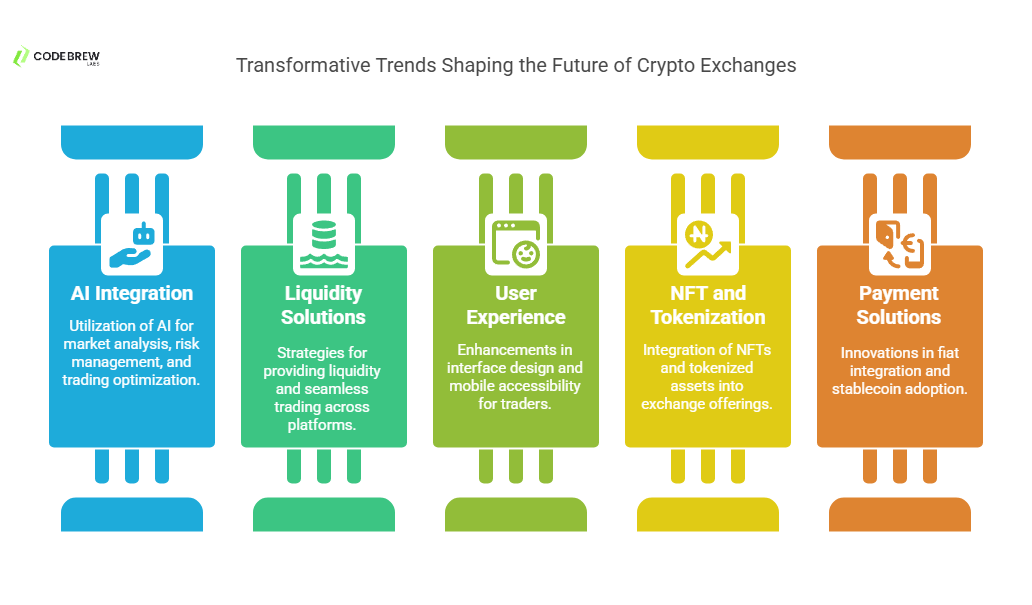

4. AI and Machine Learning in Trading

Artificial intelligence and machine learning are revolutionizing crypto trading. AI-driven trading bots can analyze market data in real-time, predict price movements, and execute trades automatically. These tools help traders maximize profits while minimizing risks.

Innovations Transforming Crypto Exchange Development

1. AI-Powered Trading Bots and Automation

AI is playing a significant role in automated trading. Advanced trading bots can execute high-frequency trades, identify market patterns, and manage risks efficiently.

2. Enhanced Security Measures

Security is a top priority for crypto exchanges. Multi-layer authentication, biometric security, and AI-driven fraud detection systems are becoming standard features to protect users’ funds and data.

3. Quantum-Resistant Cryptography

With the advent of quantum computing, crypto exchanges are adopting quantum-resistant encryption techniques to safeguard digital assets from potential threats posed by quantum computers.

4. Cross-Chain Liquidity Solutions

Cross-chain technology enables seamless asset transfers between different blockchains, improving liquidity and making trading more efficient.

Decentralized Exchanges vs. Centralized Exchanges: The Future Outlook

Pros and Cons of Centralized Exchanges (CEXs)

Centralized exchanges (CEXs) have been the dominant force in the crypto market for years. They offer high liquidity, user-friendly interfaces, and customer support. However, they also come with risks:

- Advantages:

- High liquidity and faster trade execution

- Advanced trading features like futures and margin trading

- Regulatory compliance ensures trust among institutional investors

- Disadvantages:

- Custodial nature means users must trust the exchange with their funds

- Higher risk of hacking and security breaches

- Compliance with regulations may limit user privacy

The Appeal of Decentralized Exchanges (DEXs)

DEXs operate on blockchain-based smart contracts, eliminating the need for intermediaries. They offer users complete control over their funds, making them more secure. However, they also have challenges:

- Advantages:

- Users retain control over their private keys

- Reduced risk of hacking due to decentralized infrastructure

- Lower regulatory pressure in some regions

- Disadvantages:

- Lower liquidity compared to centralized exchanges

- Slower transaction speeds due to blockchain limitations

- Limited trading features

The Rise of Hybrid Crypto Exchanges

To bridge the gap between CEXs and DEXs, hybrid exchanges are gaining popularity. They combine the benefits of both models, providing security, liquidity, and compliance in one platform. Hybrid exchanges are expected to dominate the market by 2025, offering seamless user experiences while ensuring fund security.

Regulatory Compliance and Its Impact on Crypto Exchanges

Global Crypto Regulations and Their Influence

Governments worldwide are tightening crypto regulations to prevent fraud, money laundering, and market manipulation. Crypto exchanges must comply with these regulations to operate legally and gain user trust.

KYC/AML Policies in Crypto Exchanges

Know Your Customer (KYC) and Anti-Money Laundering (AML) measures are becoming standard requirements for crypto exchanges. These policies help prevent illegal activities and ensure transparency.

How Compliance Affects User Trust

Exchanges that comply with regulations attract institutional investors and mainstream users. Compliance not only enhances credibility but also protects exchanges from legal issues and potential shutdowns.

The Role of Blockchain in Crypto Exchange Development

Enhancing Transparency and Security

Blockchain technology ensures that all transactions are transparent, immutable, and tamper-proof. This reduces the risk of fraud and increases trust among users.

Layer 2 Solutions for Scalability

Layer 2 solutions, such as Lightning Network and Optimistic Rollups, help crypto exchanges scale by reducing congestion on the main blockchain. These solutions allow for faster and cheaper transactions.

Emerging Blockchain Protocols

New blockchain protocols are being developed to improve the speed and efficiency of crypto exchanges. Technologies like Solana, Polkadot, and Avalanche offer innovative solutions for seamless trading.

Security Measures for Next-Gen Crypto Exchanges

Cold Wallet Storage for Enhanced Security

Crypto exchanges are adopting cold wallet storage solutions to protect users’ funds from cyberattacks. Unlike hot wallets, cold wallets are not connected to the internet, reducing the risk of hacking.

Two-factor authentication and Biometric Verification

Two-factor authentication (2FA) and biometric verification methods, including as facial recognition and fingerprints, are being used by exchanges to enhance user security.

AI-Driven Fraud Detection Systems

Artificial intelligence is being used to detect suspicious activities in real-time. AI-driven fraud detection helps exchanges prevent hacking attempts and fraudulent transactions.

The Impact of AI and Machine Learning in Crypto Trading

AI-Based Risk Management in Exchanges

AI-powered algorithms analyze market data and predict potential risks. This helps exchanges implement better risk management strategies.

Predictive Analytics for Trading Strategies

Machine learning models analyze historical price trends to provide predictive insights. Traders can use these insights to make informed investment decisions.

Automated Trade Execution with AI-Powered Bots

AI-driven trading bots execute trades automatically based on market conditions. These bots optimize trading strategies and maximize profits for users.

Liquidity Solutions and Market-Making Strategies

Role of Automated Market Makers (AMMs)

Automated Market Makers (AMMs) provide liquidity to DEXs by allowing users to trade assets without relying on order books. AMMs use smart contracts to facilitate peer-to-peer trading.

Cross-Chain Liquidity Aggregation

Cross-chain liquidity solutions enable seamless trading between different blockchain networks, improving the overall trading experience.

Institutional Market Making in Centralized Exchanges

Institutional market makers provide liquidity to centralized exchanges, ensuring that users can trade large volumes without significant price fluctuations.

User Experience and Interface Improvements in Crypto Exchanges

Intuitive UI/UX for Seamless Trading

A well-designed user interface is crucial for attracting traders. Exchanges are focusing on creating intuitive, easy-to-navigate platforms.

Mobile-First Approach for Crypto Trading

With the increasing number of mobile users, exchanges are prioritizing mobile-friendly platforms and dedicated apps for seamless trading on the go.

Integration of Social Trading Features

Social trading allows users to follow and copy the trades of experienced investors, making crypto trading more accessible for beginners.

The Role of NFTs and Tokenization in Crypto Exchanges

How Exchanges Are Integrating NFT Trading

Crypto exchanges are expanding their offerings to include NFT (non-fungible token) trading, allowing users to buy, sell, and store NFTs directly on their platforms.

Tokenized Assets and Their Impact on Crypto Markets

Tokenization enables real-world assets like real estate, stocks, and art to be represented as digital tokens on blockchain networks. This opens up new investment opportunities.

The Future of Fractional Ownership in Crypto Exchanges

Fractional ownership allows users to own a portion of high-value assets, making investing more accessible to the average trader.

Payment Solutions and Fiat Integration in Crypto Exchanges

On-Ramp and Off-Ramp Solutions for Fiat-Crypto Transactions

Crypto exchanges are enhancing their on-ramp (fiat to crypto) and off-ramp (crypto to fiat) solutions, making it easier for users to buy and sell digital assets with traditional currencies.

Stablecoin Adoption for Seamless Trading

Stable coins like USDT, USDC, and DAI are widely used in crypto trading, providing a stable alternative to volatile cryptocurrencies.

Crypto Debit Cards and Their Role in Mainstream Adoption

Crypto debit cards allow users to spend digital assets in real-world transactions, bridging the gap between crypto and traditional finance.

The Future of White-Label Crypto Exchange Development

Benefits of White-Label Solutions for Startups

White-label crypto exchange solutions enable startups to launch their own platforms without developing them from scratch, reducing time and costs.

Customization Trends in Exchange Development

Exchanges are offering customizable features to cater to different business models, including margin trading, staking, and yield farming.

Scalability and Security in White-Label Crypto Platforms

White-label solutions are incorporating advanced security measures and scalability options to handle growing user bases efficiently.

Conclusion: What Lies Ahead for Crypto Exchange Development in 2025 and Beyond

Crypto exchange development is evolving rapidly, driven by technological innovations and regulatory changes. The rise of decentralized finance (DeFi), AI-powered trading, and blockchain advancements will shape the future of trading platforms.

Businesses looking to enter the crypto exchange market must partner with a reliable crypto exchange development company to stay competitive. By leveraging the latest crypto exchange development services, exchanges can ensure security, scalability, and compliance while offering a seamless trading experience.

As we move into 2025, the crypto exchange landscape will continue to evolve, offering more opportunities for traders, investors, and businesses worldwide. Staying informed about emerging trends and innovations will be key to thriving in this dynamic industry.

FAQs

1. What are the key trends shaping crypto exchange development in 2025?

Decentralized exchanges (DEXs), AI-driven trading bots, hybrid exchanges, and enhanced security measures are among the key trends.

2. How does AI improve crypto trading?

AI enhances risk management, predictive analytics, and automated trade execution, helping traders optimize their strategies.

3. What role does blockchain play in crypto exchange development?

Blockchain ensures transparency, security, and scalability for crypto exchanges through decentralized protocols.

4. Are decentralized exchanges better than centralized exchanges?

Each model has pros and cons; hybrid exchanges combining both features are likely the future.

5. How can businesses launch a crypto exchange in 2025?

Partnering with a crypto exchange development company and leveraging crypto exchange development services ensures a secure and scalable platform.